Scoring Your Credit – How’s Your FICO® Score?

Shopping for a mortgage in Seattle or anywhere in Washington State? One of the first things lenders review is your credit score. While many factors affect mortgage approval, your FICO® score remains a key component in determining both eligibility and pricing.

approval, your FICO® score remains a key component in determining both eligibility and pricing.

Are you looking for a new mortgage? Enter your Quick Form here to begin a preliminary mortgage review.

How Credit Scoring Works

In today’s computer-driven lending environment, your overall creditworthiness is largely summarized by a single number: your credit score. Credit reporting agencies analyze your borrowing and repayment history to produce this score, which lenders use to assess credit risk.

The most commonly used model in residential mortgage lending is the FICO® score, originally developed by Fair Isaac and Company.

Credit Reporting Agencies Used in Washington Mortgage Lending

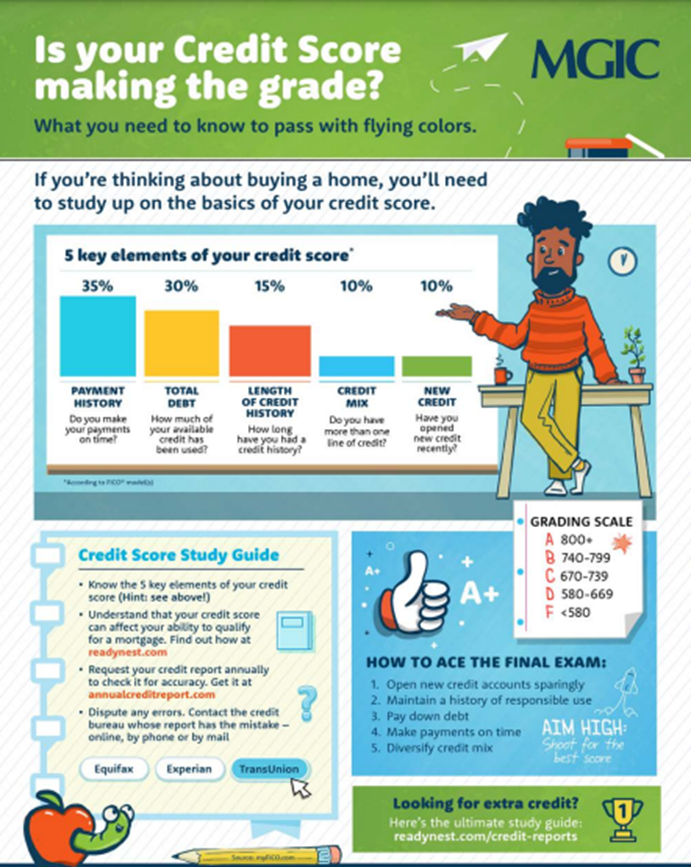

Mortgage lenders in Washington State typically review credit reports from all three national credit bureaus:

- Equifax

- Experian

- TransUnion

Each bureau uses its own scoring model and data, which is why scores may differ slightly. For most conventional, FHA, VA, and jumbo loans in Washington, lenders use the middle (mid-score) of the three when determining loan eligibility and pricing.

What Factors Affect Your Credit Score?

While scoring formulas vary, the following factors are generally used by all three bureaus:

-

Credit history length

Have you had credit accounts for many years, or only a short time?

-

Payment history

Have any payments been more than 30 days late?

-

Credit balances

How many accounts do you have, and how much do you currently owe—especially on credit cards?

-

Credit inquiries

How often have lenders pulled your credit for the purpose of extending new credit?

These factors are weighted differently depending on the scoring model, but together they result in a score that typically ranges from 300 to 800. Higher scores indicate lower perceived risk.

Most homebuyers in Seattle and surrounding areas today have credit scores above 620, though minimum requirements vary by loan program and lender.

Why Credit Scores Affect Mortgage Rates in Washington

Credit scores are used for more than determining whether you qualify for a mortgage. They also play a meaningful role in interest rate pricing.

- Higher credit scores may qualify for more favorable rates and terms

- Lower scores may result in higher rates, additional pricing adjustments, or fewer program options

Even a small difference in credit score can impact monthly payments and long-term interest costs, particularly in higher-priced markets like King, Snohomish, and Pierce Counties.

Improving Your Credit Score

Raising your credit score usually takes time. While some companies advertise quick fixes, they cannot do anything you cannot do yourself—often at no cost—other than disputing inaccurate information on your behalf. What can you do to raise your FICO score? Very little in the short term. Test your knowledge about credit score myths or facts?

Steps that may help over time include:

- Making all payments on time

- Reducing credit card balances

- Avoiding unnecessary new credit inquiries

- Appealing incorrect or outdated items on your credit reports

Be cautious of services that promise rapid or guaranteed improvements.

Getting Your Credit Reports and Scores

Before you can improve your credit, you should review your reports from each bureau for accuracy.

-

Fair Isaac operates www.myFICO.com, which allows you to purchase your credit scores and credit reports from all three bureaus. The site also offers tools and educational resources to help you understand what actions may have the greatest impact on your score.

-

You are also entitled to a federally mandated free credit report from each bureau once per week at

AnnualCreditReport.com.

These reports do not include a free credit score, but you may upgrade for a reasonable fee.

Here are step by step instructions on how to request for your free credit report. We recommend that you request to opt-out of firm offers of credit or insurance prior to pulling your own credit report. We do not share your personal information; however, the 3 major credit bureaus (Experian, Equifax and TransUnion) do.

A More Informed Washington Homebuyer

Understanding how credit scores work helps you become a more informed consumer and positions you more effectively when applying for a mortgage in Washington State. Reviewing your credit early can help reduce surprises and support smoother underwriting once you are under contract.

Now that you have all the facts, you'll be a more informed consumer and you'll be better positioned to obtain the right mortgage for you. Here are samples from Credco credit report and Clear choice credit report.

Disclaimer: This content is for informational purposes only and is not a commitment to lend or an offer of credit. Loan programs, terms, and requirements are subject to change and may vary based on individual qualifications and property characteristics.